Note: A new version of LocalPay launched Nov 15th, 2023 for users in the United States.

If you are an existing LocalPay in the United States, you will be contacted about migrating to this version.

This article is applicable to all Canadian users.

LocalPay is Local Line’s own payment platform that lets you accept credit card payments and save money with lower processing fees!

LocalPay is also fully integrated with Local Line, so you can process refunds (full or partial) right from your Local Line account.

With LocalPay you can track all of your transactions and bank payouts directly in your Local Line account.

Process a refund with LocalPay

View and export LocalPay reporting

FAQ

Is LocalPay available for all regions?

Which credit cards does LocalPay support?

Does LocalPay support interac debit cards?

Does LocalPay support Snap/EBT payments?

What are the credit card processing rates for LocalPay and how are they billed?

How much can I save by using LocalPay?

How soon are transaction funds deposited in my bank account after the transaction is processed?

Are processing fees returned when a refund is issued?

What is my customer’s experience at checkout when I have LocalPay enabled?

Does LocalPay offer the same reporting that Square and Stripe do?

Does LocalPay integrate with any POS system?

-

Is LocalPay available for all regions?

-

- LocalPay is only available to U.S. and Canadian customers at this time. We plan to make it available in other countries in the future.

-

Which credit cards does LocalPay support?

-

- Visa, Mastercard, AMEX (US Merchants only) and Discover.

-

Does LocalPay support interac debit cards?

-

- Yes.

-

Does LocalPay support Snap/EBT payments?

-

- Not at this time.

-

What are the credit card processing rates for LocalPay and how are they billed?

-

- The rates are based on the Local Line subscription you have. See our pricing page for details.

- By default, payouts are calculated daily and the percentage of transaction fee is taken from the full batch amount prior to deposit. If you prefer that the fees are debited separately after the payout is deposited, email support@localline.ca.

- The per transaction fee is batched and debited at the end of each month.

- The rates are the same whether you process the credit card payment via your back office or your customer does via your storefront.

-

How much can I save by using LocalPay?

-

- The amount you save depends on how much your sales are that are paid by credit card. The average Local Line customer will save $480 per year, while some larger Local Line customers will save more than $10,000 per year. Use our savings calculator to see how much you can save!

-

How soon are transaction funds deposited in my bank account after the transaction is processed?

-

- They are deposited in 2-3 business days, based on your bank processing cycles. The time of day the deposit is made varies from bank to bank, but is typically at the start of the business day for your bank. If your bank account details change at any time after submitting your LocalPay application, contact support@localline.ca with the details to ensure your payouts are deposited in the correct account. The payout is termed "ACH electronic credit merchant services net settle" on your bank statements.

- By default, payouts are calculated daily and the fees are taken from the full batch amount prior to deposit. If you prefer that the fees are debited separately after the payout is deposited, email support@localline.ca.

- If you prefer to have payouts done on a monthly basis, email support@localline.ca.

-

Are processing fees returned when a refund is issued?

-

- A portion of the processing fee is returned, and that amount varies depending on which merchant category code (MCC) you specified in your application and were approved for.

-

How do I set up LocalPay?

-

- See Connect LocalPay.

-

What is my customer’s experience at checkout when I have LocalPay enabled?

-

- Your customer’s checkout flow is the same as if you have Square or Stripe connected, with only minor stylistic differences. Your customer sees the credit card payment option at checkout and is prompted to enter their card details.

-

Does LocalPay offer the same reporting that Square and Stripe do?

-

- In addition to the reporting available with our Reports & Analytics feature, which includes data on sales by payment method, fees and taxes, and payment status, you can view your LocalPay transaction history and bank payouts in your Local Line account.

-

Does LocalPay integrate with any POS system?

-

- Not at this time.

Connect LocalPay

- Complete the online application.

- After your application is approved, add a payment method for LocalPay.

Your application goes through these stages:

- Not connected - You have not yet started your application.

- Application in progress - You have started your application but have not completed and submitted it yet.

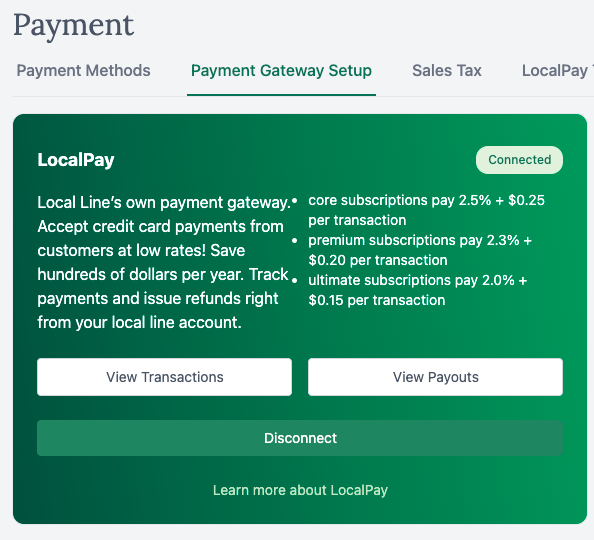

- Connected - Your application is approved and LocalPay is connected!

To connect LocalPay you need to share some information about your business along with your bank account details. You will want to have that information handy when you start your application, but if you need to step away from the application after you have started it your progress is saved.

After you submit your application, you receive an email from “PayEngine Merchants” that outlines key details of your application and the fee structure. Sign and return the document in that email to proceed with the underwriter review. The underwriter review that is done to validate your identity and business takes ~5 business days for U.S. users and 1-2 weeks for Canadian users to complete.

Complete your application

If information provided on your application changes, such as your business type or bank account details, that you must contact support@localline.ca. In the case of any sensitive information like your bank account details, you are sent an email from the processor to send that information securely. There is a $20 fee for making changes to your application information.

- In your Local Line account, go to the Payment page.

- Click the Payment gateway setup tab.

- Click Connect with LocalPay. This updates the LocalPay status to Application in progress.

- Click View application to enter your application details.

- Enter details for steps 1-6:

- Business type

- MCC - The MCC is your merchant category code. In most cases, "5411 - Grocery Stores, Supermarkets" is applicable.

- The Mastercard description for the 5411 MCC code is: “Merchants that sell a complete line of food merchandise for home consumption. Food products for sale include groceries, meat, produce, dairy products, and canned, frozen, prepackaged, and dry foods. Other products for sale may include a limited selection of housewares, cleaning and polishing products, personal hygiene products, cosmetics, greeting cards, books, magazines, household items, and dry goods. These merchants also may operate specialized departments such as an in-store deli counter, meat counter, pharmacy, or floral department”

- Business details

- DBA details = "doing business as" or the name of your business.

- Website - Use your Local Line store URL which you can copy from your Price Lists page. If you have multiple price lists, use your default, public price list URL.

- How many days does it take for the cardholder to receive their product or completed service? - Use the average frequency from your fulfillment plans.

- Tax exempt - Only specify Yes if you are federally classified as a non-profit. You are prompted later in the application to attach your supporting documentation to prove your exemption.

- Number of locations - Count of all locations your sell your products at.

- Business to business % - Specify 0 if you only sell to households. But, if you sell wholesale or to restaurants indicate the approximate distribution of your sales across those channels.

- Your details

- You must specify at least one owner that has at least 25% ownership of the business. The exception to this is if you are a farmers nonprofit cooperative where ownership is < 25% per person.

- Credit card processing

- Card swipe - This is applicable if you have used a POS where a card is swiped.

- Manually keyed (CP) - This is applicable if you have used a POS where the card was present and manually keyed in.

- Manually keyed (CNP) - This is applicable if you have used a POS where the card was NOT present and manually keyed in.

- e-Commerce - If you have only accepted online payments, enter 100.

- Projected volume - in this section, refer to your historical data to project future credit card processing amounts.

- Qualified processing method - In many cases, this will be EDC retail. EDC is the technology that retrieves the customer's banking information and captures the draft, or the amount due.

- Average transaction amount

- If you have never offered a credit card payment method before, enter your average order amount. If you are on a LL Core plan or higher, you can grab this from your Reports page > Orders tab.

- If you have offered a credit card payment method before, you can get this in your Local Line account on your Orders page. Just filter the table by Payment method for Credit card, export the records for your last peak season, and average the order total in the downloaded file.

- Highest ticket amount - If you don’t have an approximate sense of this, on your Orders page in your Local Line account, click on the Total column header to sort it in descending order, meaning highest amount to lowest.

- Total monthly sales - You can get this amount from your Reports tab metrics or export records from your Orders page.

- AMEX monthly card sales (Canadian applications only) - If you have processed any historical transactions with AMEX, specify that amount or greater. If you have not processed any historical transactions with AMEX but have been asked if you accept AMEX by a customer, then specify a project amount that is greater than 0. For this question, it is best to specify an amount greater than 0 to account for the future possibility of processing AMEX transactions.

- Business type

-

- Bank details

- Submission

- Watch your inbox for the email from “PayEngine Merchants” on "Elvaon" letterhead. PayEngine is a software integration partner that helped Local Line build LocalPay, and Elavon is the underwriter that validates your application. Return the signed document by email. The document contains contact details for our partner together with your contact details. Our partner acts as a bridge between the underwriter and you/Local Line to ensure you are only contacted for things that require your attention. If further clarification on application details is needed, you may receive additional emails or be contacted by phone.

- The only fees you are responsible for are your transaction processing rates which are determined by your Local Line subscription. See the Online payments section on our pricing page to confirm your rates. The fees noted in section 10 of the signature document are applicable only in the conditions specified. For example, the chargeback fee. If your customer disputes a charge made to you, a fee of $15 in your currency is applicable. This is standard practice for online payment gateways, such as Square whose fee can be as high as $25. The fees outlined in section 13 of the signature document are not applicable to Local Line users.

Add a payment method for LocalPay

You know your application is approved when you see the Connected status in the green LocalPay panel on your Payment page Payment gateway setup tab, and you also receive an email from Local Line.

To make LocalPay visible in your checkout you need to add a payment method for it:

- On your Payment page Payment methods tab, click +Add payment method.

- Click to select LocalPay gateway.

- Enter a Payment method name, e.g. “Credit card”.

- [Optional] Enter the Instructions for using that method.

- Click to select which price lists you want this payment method to be available for.

- Click Save.

Note: If you do not use LocalPay for 90 days the gateway is closed due to inactivity. To reopen the gateway you must start a new application and complete that process again.

If you also have a Stripe or Square gateway enabled, you can disable it by unassigning it from the price list(s) it’s assigned to:

- On your Payments page Payment methods tab, click the dot menu for the Square or Stripe payment method.

- Click Edit payment method.

- Scroll to the Select price lists section and de-select all price lists.

- Click Save.

Changing account details

If you need to change any details of your application, email support@localline.ca. If you need to change your bank account information, you will be sent an email with a link to share that information securely with the processor. A $20 fee applies for that change, and it takes 3-5 business days before the change goes into effect.

Process a refund with LocalPay

Processing fees are not returned when a refund is applied. A refund takes 5-10 days to appear on your customer’s credit card statement.

There are two ways to process a refund with LocalPay:

- Cancel the order - full refunds only.

- Refund from your Payments page LocalPay transactions tab - full or partial refunds.

Refund by cancelling an order

- Go to your Orders page.

- Click the dot menu for the order you want to cancel and refund.

- Click Cancel order.

- Select Refund order with [the name you gave your LocalPay payment method].

- When you use this option, the order's payment status changes to Refunded.

- Click Cancel order.

Refund from the LocalPay transactions tab

When you use this option the order's payment status is not updated to Refunded. You may want to add an order note to indicate the refund until this is improved.

- Go to your Payments page.

- Click the LocalPay transactions tab.

- Click the row for the order you want to refund.

- Click Refund / Void.

- Enter the Amount.

- Enter a Reason.

- Click Refund / Void.

Credit card authorizations

When a customer wants to pay for an order with a product that you have enabled the Needs approval for, payment is only authorized for +/- 15% of the total of the order until you update and approve the order. The authorization expires after 7 days.

If after you approve the order your customer wants to use a different credit card than the one they specified at checkout, you can revoke the authorization and request new credit card details. See Approve an order for a full explanation. In that scenario, the authorization is removed for usage on that order but remains in an authorized state until it expires in 7 days. The authorization is still displayed on your LocalPay transactions tab but your customer will not be charged the revoked authorization amount.

View and export LocalPay reporting

You can see your transaction and bank deposit payout reporting in your Local Line account Payment page:

To view transaction reporting, click the LocalPay Transactions tab.

- Click Filter to filter by Date, Amount, Status, Payment method, Refund type.

- Click Export CSV to download the data to a file.

- You can click on a table row to see more detail. You can also process a partial refund from this view.

To view detailed payout reporting, click the LocalPay Payout Detail tab. This data is exportable. Use this export to reconcile your gross vs net sales.

- Click Filter to filter by Date, Amount, Refund type.

- Click Export CSV to download the data to a file.

- You can click on a table row to see more detail.

- Click All transactions to view the transactions the payouts relate to. Click Export CSV to download this data to a file.

To view batched payout reporting, click the LocalPay Payout Batches tab.

- Click Filter to filter by Date, Amount, Refund type.

- Click Export CSV to download the data to a file.

- You can click on a table row to see more detail.

- Click Export batch summary to download the detail table to a file.

- Click Export transactions to download payout detail with transaction references (transaction date, customer name, etc.).

Tax forms for U.S. accounts

The 1099K form is mailed to you at the end of January each year. You can expect to receive them at the beginning of February.

Disconnect LocalPay

- Go to your Payment page.

- Click the LocalPay transactions tab.

- Click Disconnect.